Russian Railway Rate Hike to Push Up Coal Export Costs as Demand Falls

Release time:

2024-12-05 14:55

Source:

Russian Railways (RZD) will raise rail freight rates by nearly 14% from December 1, 2024, according to CCA Analysis on November 9th.

It is reported that RZD has succeeded in obtaining approval of the proposed tariff adjustments for 2025, which will result in a 13.8% increase in rail freight tariffs from December 1, 2024 onwards. In addition, the tariff for open-top railcars running empty will increase by 10%. What's more, the preferential coefficients for coal export transportation will be permanently abolished, despite heavy losses of coal companies and almost record profits of Russian Railways.

According to the tariff adjustment plan, the tariffs will be adjusted in one step from December 1, although a two-step increase from November 1 or a one-step increase from January 1, 2025 was previously considered.

The new hike includes targeted surcharges, including a 7 percent surcharge for major repairs and a 1 percent surcharge for transportation security. Earlier, it was also believed that the surcharges could be removed.

Despite the difficult market situation, the downward adjustment factors of 0.4 and 0.895 for long-distance export coal tariffs (suspended from June 2022) were eventually removed in their entirety at the request of exporters and coal-producing region authorities.

Empty mileage rates for open, station and covered cars will increase by 10 percent. There is also a provision for targeted indexing of certain tariffs.

At the same time, RZD's profit in the first half of 2024 amounted to $2.6 billion, while the coal miners' losses for the same period were estimated at $7.2 billion.

In addition, Russian Railways is proposing not to extend the eastern coal transportation agreement with the mines by 2025 in order to refocus on more profitable cargoes. However, measures to reduce coal traffic and ease pressure on the rail network in 2024 have not had the desired effect, as RZD has not yet managed to replace lost coal volumes with other cargoes.

In January-September 2024, the volume of coal exported by rail transport fell to 140.8 million tons, a decrease of 14.5 million tons or 9.3%. Of this, 85.5 million tons of coal was exported by rail transport in the eastern direction, accounting for 61% of total exports.

Railroad freight rate increase will push up the cost of power coal exports

According to S&P Global (S&P Global) November 15 release of information, in the case of falling demand, the Russian railroad tariff increase may increase the cost of power coal exports.

Russian coal exporters are facing declining demand in several key markets due to sanctions on a number of Russian coal companies, and in this case, Russian railroads have raised freight prices.

“With Russian coal miners already posting losses since 2024, higher freight rates will increase costs and reduce the market competitiveness of Russian power coal, providing room for coal from Colombia, South Africa, and the U.S. to gain market share in the seaborne market,” said Pat Se Khoo, senior analyst at Standard & Poor's Global Commodity Insights .

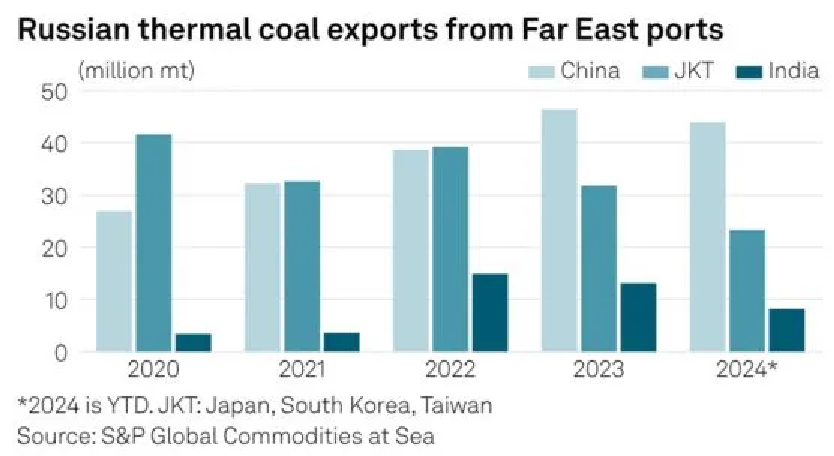

S&P Global Maritime Commodities data shows that as of November 13, Russian thermal coal exports were only 110 million tons, compared to 133 million tons for all of 2023 and 148 million tons for 2022, according to S&P Global Maritime Commodities data.

Since 2024, Russia has supplied 43.9 million tons of power coal to China, 8.2 million tons to India, and 23.23 million tons to the markets of Japan, South Korea, and Taiwan.

Market sources expect exports to slow down this year due to less competitive prices. “The new rise in railroad freight will lead to higher selling prices for Russian coal.” A UAE-based analyst who deals in Russian coal said. “Buyers will either need to accept higher prices or seek cheaper alternatives. However ...... there is a shortage of high calorific value coal spot, so buyers will probably end up paying a premium.”

Higher transportation costs are eroding margins for Russian suppliers, tightening cargo availability on the East Coast and putting pressure on high liquidity at the CV 6,000 kcal/kg NAR grade.

Some new coal projects were put on hold when Russian Railways raised rail tariffs by 10.75% in 2023, a Singapore-based trader said. The result could be similar this year, with Russian power coal exports likely to fall further.

The tariff hike could also affect export volumes to price-sensitive buyers such as India and China, as outbound coal shipments rely on rail transportation.

“The ratio of exports to China to exports to other markets has been 50:50 for the past nine months,” a Russian trader said. “However, as we raise freight rates, this ratio may fall as less coal may be delivered to the Far East, favoring the higher end of the market including South Korea, Japan and Malaysia, among others.”

Related News

Russian farmers have threshed nearly 13.3 million tons of sunflower seeds

The gross sunflower harvest by the end of the second ten-day period in October was approximately 13.3 million tons, having threshed 8.8 million hectares (72% of the total area). This is 1.3 million tons less than the previous year, according to the RUSEED analytical center.

The Ministry of Agriculture expects Russia to "touch" the record for oilseed harvests in 2025

Russia may reap a record harvest of oilseed crops this year, the Ministry of Agriculture predicts.

Russia's oilseed harvest could reach 34.5 million tons in 2025

Russia's oilseed harvest in 2025 could reach 34.5 million tons, up 14% from last year, according to Forbes, citing Margarita Svischeva, head of the RUSEED analytical center.

Russian coal production rose 0.1% year-on-year in the first three quarters of 2025

According to the latest preliminary monthly industrial production statistics released by the Russian Federal State Statistics Service (Poccrara) on October 22, Russia's total coal production from January to September 2025 reached 314 million tons, basically flat with a slight increase of 0.1% compared to the same period last year.

This year's rapeseed production in the Trans-Baikal region is a quarter higher than last year's

Harvesting continues in the Trans-Baikal Territory. This year, yields of both cereals and oilseeds in the region are above 2024 levels. Rapeseed yields have increased by a quarter, according to the regional government website.

According to the Russian Agricultural Research Center (RUSEED) Analytical Center, Russia has already planted approximately 70% of its winter crop plan for the 2026 harvest. The total area is projected at 19.8 million hectares.

手机浏览

手机浏览