In the first three quarters, coal transshipment at Russian seaports decreased by 11.2% year-on-year.

Release time:

2024-12-30 09:27

Source:

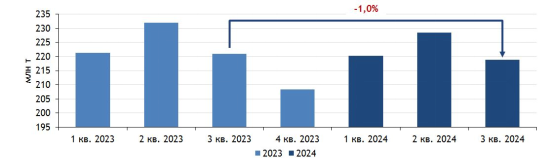

According to recent information jointly released by IAA PortNews and the IPEM Institute, the cargo throughput of Russian seaports has continued to decline this year, with a 1% decrease in throughput in the third quarter of 2024 compared to the same period last year, marking the fourth consecutive quarter of year-on-year decline.

In the third quarter of this year, the cargo throughput of Russian seaports was 218.9 million tons, a decrease of 1% compared to the same period last year. The most significant decline was in the transshipment of ferrous metals, which fell by 15.5% compared to the third quarter of 2023. Coal transshipment also saw a significant decline, with 48.1 million tons transshipped in the quarter, down 11.1% year-on-year. Factors limiting coal exports include railway infrastructure and continuously declining global coal prices. The railway infrastructure issues include limited capacity on the eastern mountain route and limited railway access to ports. The sluggish global coal market has led to a more than 30% decrease in coal export profits from the Sea of Azov-Black Sea and Arctic basins compared to the third quarter of last year. Additionally, limiting factors include coking coal export tariffs and Western sanctions.

In the third quarter, Russia's seaport grain transshipment volume decreased for the first time in 2024, down 6.2% year-on-year. However, after a long decline, oil prices have slightly increased by 0.3%. Oil product transshipment grew by 13.7% year-on-year, and liquefied gas increased by 7.8%. At the same time, container cargo transshipment grew by 6.8%, and fertilizer increased by 10.2%. The largest increase in transshipment volume in the third quarter was for ores, which grew by 36.9% year-on-year.

In the first three quarters, the total cargo throughput of Russian seaports reached 667.4 million tons, a decrease of 1.0% compared to the same period last year. Among them, coal transshipment totaled 143.5 million tons, down 11.2% year-on-year; oil transshipment decreased by 0.9%, while oil products increased by 5.3%, and liquefied natural gas grew by 4.5%; grain transshipment increased by 4.3%, fertilizer transshipment grew by 21.4%, container cargo transshipment rose by 9.6%, ore transshipment increased by 11.9%, and ferrous metal transshipment decreased by 14.2%.

In the third quarter, only the cargo transshipment volume at Baltic Sea ports increased, growing by 12.9% year-on-year. During the same period, cargo transshipment volume at Far East basin ports decreased by 4.1%, while transshipment volumes at Sea of Azov-Black Sea and Arctic basin ports fell by 6.6% and 7.9%, respectively. The largest decline was seen at Caspian Sea basin ports, where transshipment volume dropped by 15.2%.

Marine Ports of Russia. Q3 2024

Growth in Transshipment by Basins (Q3 2024 vs Q3 2023)

In the first three quarters, among Russia's five major regional ports, cargo transshipment volumes at Baltic Sea basin ports and Caspian Sea basin ports increased by 9.6% and 9.2% year-on-year respectively, while cargo transshipment volumes at Far East basin ports decreased by 2.7%, and those at Sea of Azov-Black Sea and Arctic basin ports fell by 7.2% and 5.7%, respectively.

Related News

Russian farmers have threshed nearly 13.3 million tons of sunflower seeds

The gross sunflower harvest by the end of the second ten-day period in October was approximately 13.3 million tons, having threshed 8.8 million hectares (72% of the total area). This is 1.3 million tons less than the previous year, according to the RUSEED analytical center.

The Ministry of Agriculture expects Russia to "touch" the record for oilseed harvests in 2025

Russia may reap a record harvest of oilseed crops this year, the Ministry of Agriculture predicts.

Russia's oilseed harvest could reach 34.5 million tons in 2025

Russia's oilseed harvest in 2025 could reach 34.5 million tons, up 14% from last year, according to Forbes, citing Margarita Svischeva, head of the RUSEED analytical center.

Russian coal production rose 0.1% year-on-year in the first three quarters of 2025

According to the latest preliminary monthly industrial production statistics released by the Russian Federal State Statistics Service (Poccrara) on October 22, Russia's total coal production from January to September 2025 reached 314 million tons, basically flat with a slight increase of 0.1% compared to the same period last year.

This year's rapeseed production in the Trans-Baikal region is a quarter higher than last year's

Harvesting continues in the Trans-Baikal Territory. This year, yields of both cereals and oilseeds in the region are above 2024 levels. Rapeseed yields have increased by a quarter, according to the regional government website.

According to the Russian Agricultural Research Center (RUSEED) Analytical Center, Russia has already planted approximately 70% of its winter crop plan for the 2026 harvest. The total area is projected at 19.8 million hectares.

手机浏览

手机浏览